ADHD makes up 8% of the UK’s neurodivergent population.

We interviewed people with attention deficit hyperactivity disorder to learn more about their relationship with personal finance.

I provided creative direction, experience design, user interface design, and 3D art. Made together with Allison Fitzgerald, Alex Fried, and Martin Rees for D&AD New Blood 2023.

People with ADHD struggle with impulsivity and disorganization. These struggles + personal finance = impulsive spending, overdue debts, and missed payments.

The diagnostic name implies attention deficiency, but the truth is attention is actually so excessive, it’s important for the ADHD brain to feel stimulated by tasks at hand.

Banking is Set Up for Data, Not People.

The linear processes and monotony of online banking is a huge hurdle for ADHD brains, forcing them to put blinders on their finances and sink deeper into bad habits.

Making a habit of checking your account and being financially aware leads to more efficient banking, improved financial planning, and is vital for a better banking experience.

In order to engage this audience and foster a habitual relationship with banking, Barclays is making things personal.

Introducing

Gemma

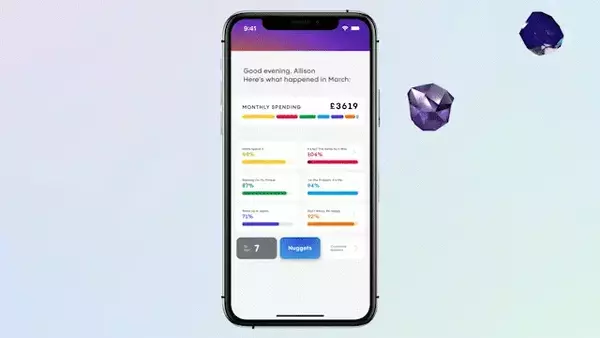

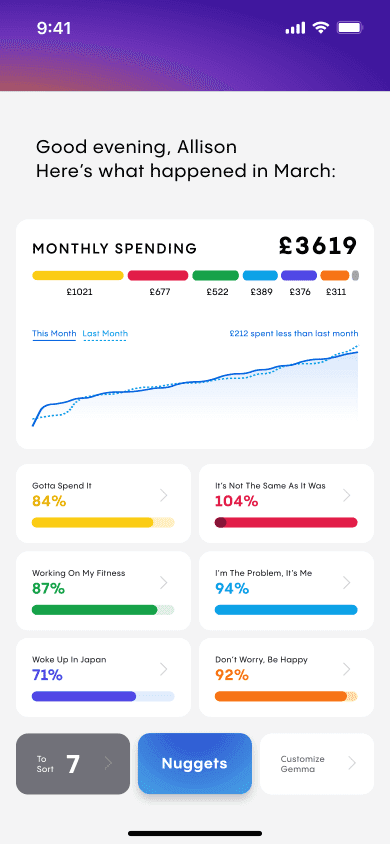

Customizable spending categories, based on users’ personal values

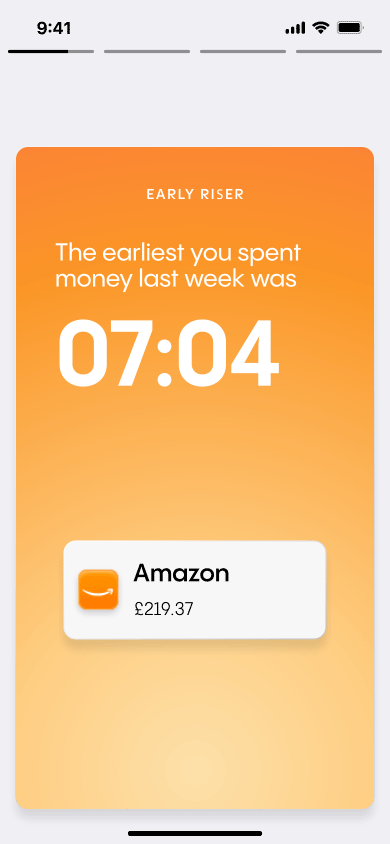

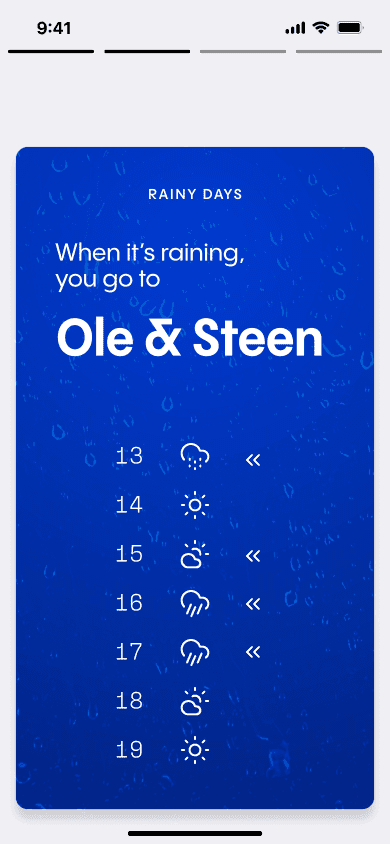

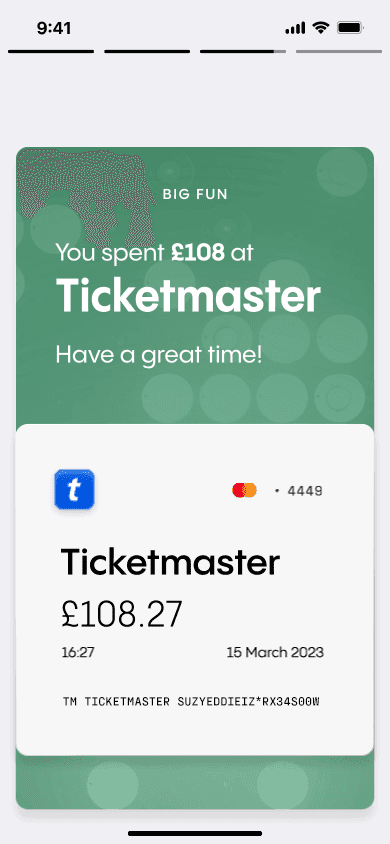

Month end statements full of personal insights about daily spending habits

Visual design that breaks away from category conventions through intentional color and depth